vermont state tax withholding

Single or Head of Household. How To Avoid The 30 Tax.

Vermont Income Tax Vt State Tax Calculator Community Tax

To help employers calculate and withhold the right amount of tax the IRS and the Vermont Department of Taxes issues guides each year that include withholding charts and tables.

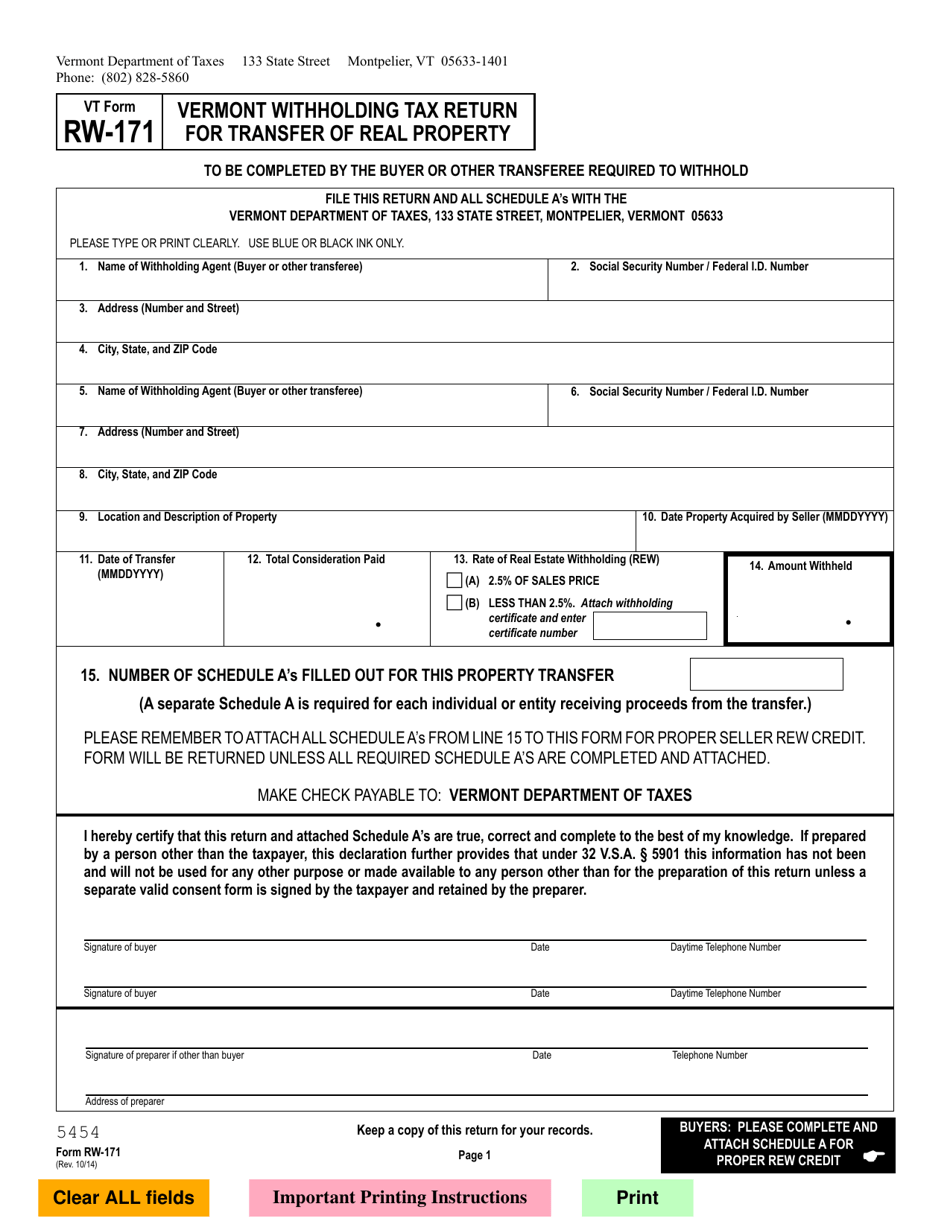

. If the seller is a nonresident the buyer is required to withhold 25 of the sale price and remit it to the Vermont Department of Taxes. The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. If Federal exemptions were used and there are additional withholdings proceed to step 8.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. Employers who pay employees in Vermont must register with the VT Department of Taxes for a Withholding Account Number and register with the VT Department of Labor for an Employer Account Number. Contact the Vermont Department of Taxes at 802 828-2865.

Vermont charges a progressive income tax broken down into four tax brackets. Tax Withholding Table. Kingdom Life Church Maine.

Before sharing sensitive information make sure youre on a state government site. Vermont State Tax Withholding. Overview of Vermont Taxes.

The more you withhold the more frequently youll need to make. Restaurants In Matthews Nc That Deliver. Now that were done with federal payroll taxes lets look at Vermont state income taxes.

In Vermont there are three main payment schedules for withholding taxes. Employees who make 204001 or more will hit the highest tax bracket. Apply online at the VT Secretary.

The income tax withholding for the State of Vermont includes the following changes. Find your gross income. PA-1 Special Power of Attorney.

Plan the correct withholding rate is 6 of the deferred payment. For example if you want your employer. If you pay wages or make payments to Vermont income.

When real estate is sold in Vermont state income tax is due on the gain from the sale whether the seller is a resident part-year resident or nonresident. If Federal exemptions were used and there are additional withholdings proceed to step 8. The Single Head of Household and Married annual income tax withholding tables have changed.

Or to avoid withholding and paying payroll taxes. Vermont School District Codes. Essex Ct Pizza Restaurants.

The Single Head of Household and Married tax tables has changed. Fill out the IRS Identity Theft Affidavit FORM 14039. Vermont Department of Taxes Withholding Account Number.

If you want even more control over your tax withholding you can also specify a dollar amount for your employer to withhold. Soldier For Life Fort Campbell. Sign Up for myVTax.

How to File For Buyers. Your payment schedule ultimately will depend on the average amount you withhhold from employee wages over time. Semiweekly monthly or quarterly.

If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. The annual amount per exemption has increased from 4050 to 4250.

Income Tax Rate Indonesia. When you receive your payeither by direct deposit or paper. The Amount of Vermont Tax Withholding Should Be.

Delivery Spanish Fork Restaurants. If the Amount of Taxable Income Is. If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding.

Vermont State Tax Withholding. No action on the part of the employee or the personnel office is necessary. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

The amount of the tax is 25 of the gross sale price eg with a contract sale price of 25000000 the withholding tax is 625000. Check the 2019 Vermont state tax rate and the rules to calculate state income tax. No action on the part of the employee or the personnel office is necessary.

Reporting and remitting vermont income tax withheld. Restaurants In Davis Ca Open Late. Beginning July 1 2004 the new employer rate for most employers is one percent 1.

Find your pretax deductions including 401K flexible account contributions. Up to 25 cash back File Scheduled Withholding Tax Payments and Returns. The state tax is payable on the first 15500 in wages paid to each employee during a calendar year.

State income tax SIT withholding State income tax SIT is withheld from employee earnings each payroll and later paidthere are a few factors that go. The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes. The 2022 tax rates range from 335 on the low end to 875 on the high end.

The annual amount per exemption has increased from 4250 to 4350. Account Numbers Needed. The states top income tax rate of 875 is one of the highest in the nation.

State government websites often end in gov or mil. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. The withholding is based on both the deferred payment and any income that may be derived from the deferred compensation.

Mi Tierra Restaurant Locations. How to Calculate 2019 Vermont State Income Tax by Using State Income Tax Table. The policy behind this tax is to allow the state to grab a portion of the sellers proceeds before they leave.

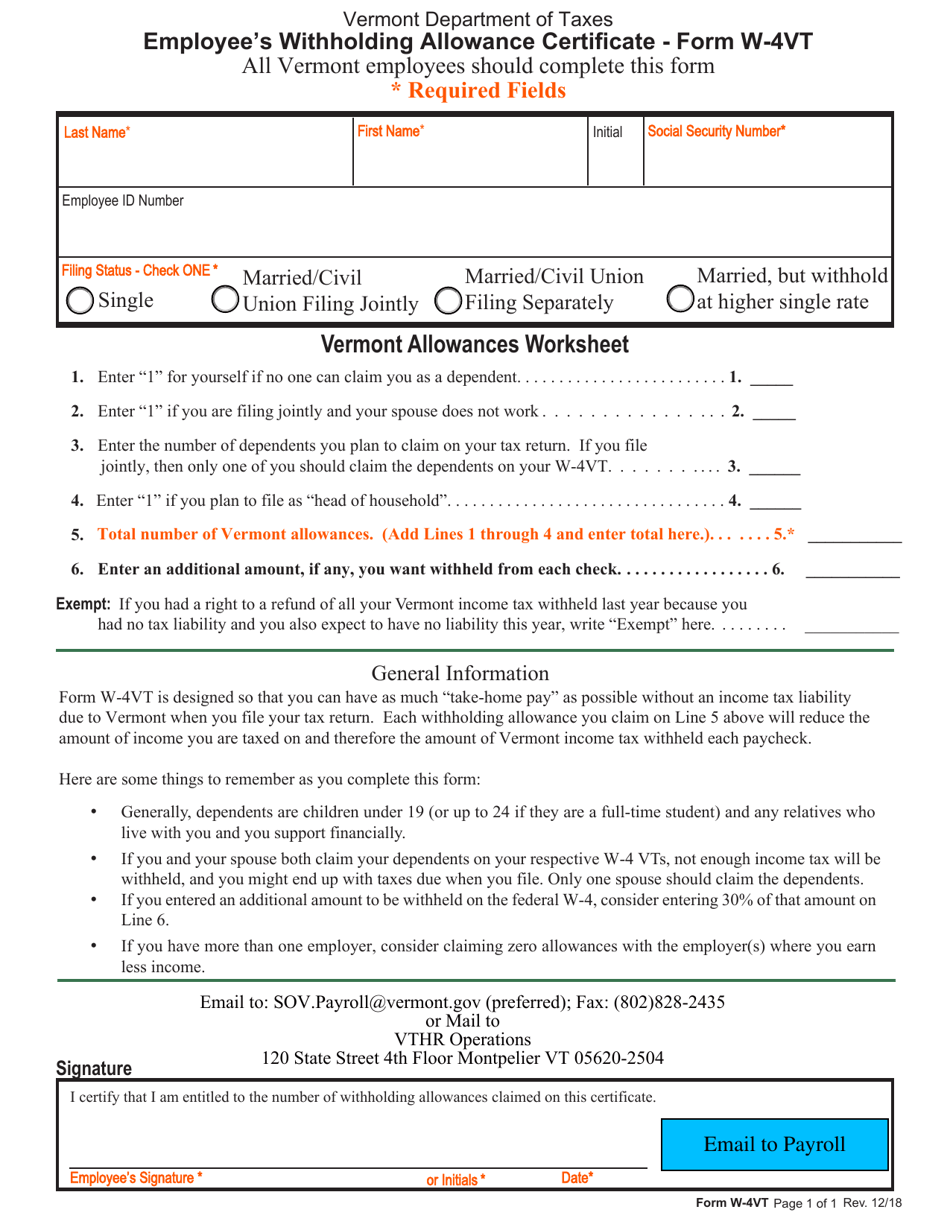

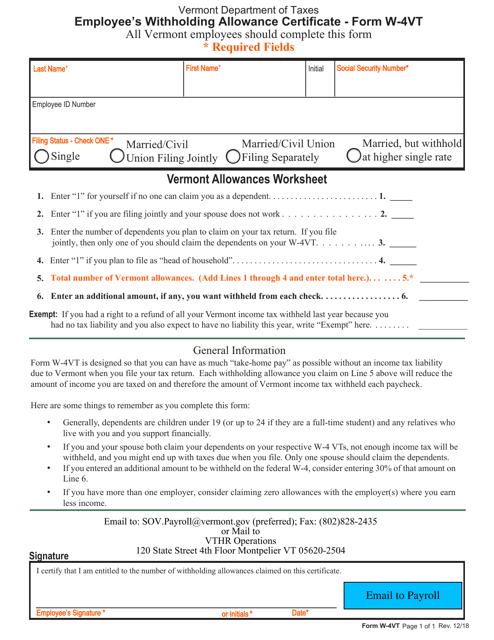

W-4VT Employees Withholding Allowance Certificate. Opry Mills Breakfast Restaurants. Find your income exemptions.

IN-111 Vermont Income Tax Return. Reporting and Remitting Vermont Income Tax Withheld. Employers pay unemployment taxes at a New Employer rate until such time as they earn a rate based on their experience with unemployment.

Vermont has a progressive state income tax system with four brackets. 8 rows The income tax withholding for the State of Vermont includes the following changes. State of Vermont.

In Vermont sellers of real property who are not residents of the state are subject to a real estate withholding tax collected at the time of closing. 1st floor lobby 133 state street. WHT99999999 WHT 8 digits.

Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax.

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Individuals Department Of Taxes

Vt Form In 111 Download Fillable Pdf Or Fill Online Income Tax Return 2018 Vermont Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

Vermont Income Tax Vt State Tax Calculator Community Tax

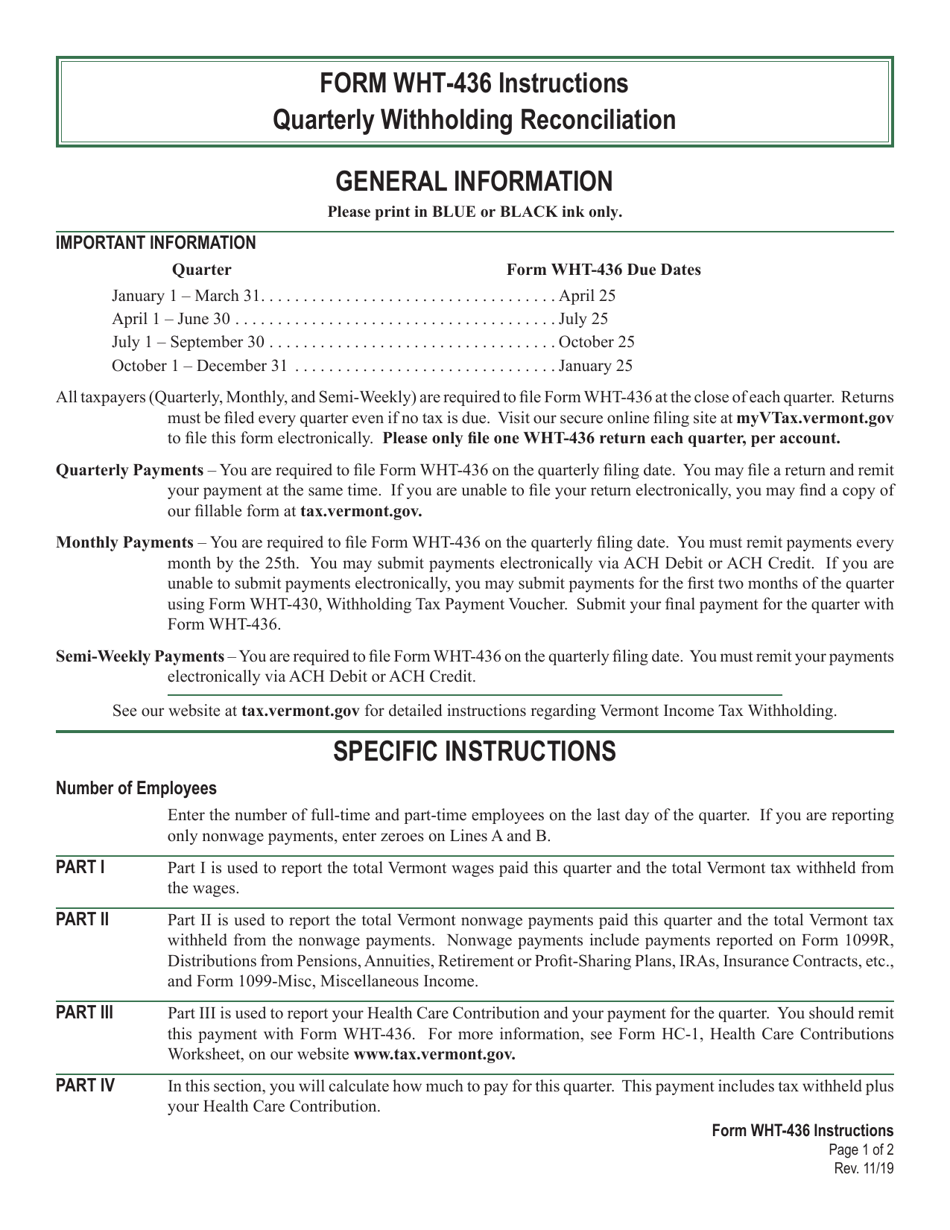

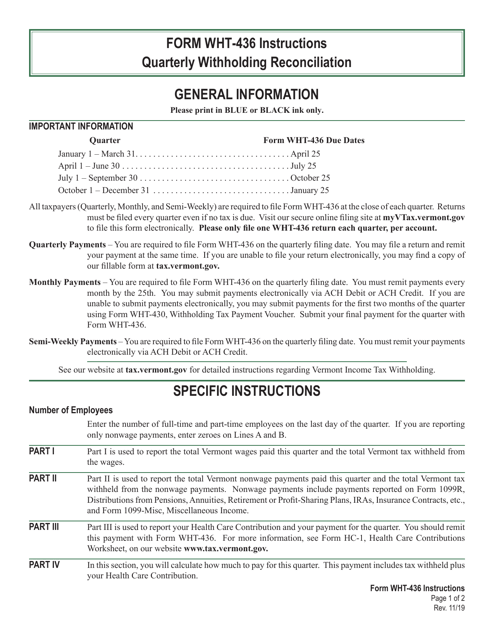

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

Your Tax Bill Department Of Taxes

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

W 4vt Fill Online Printable Fillable Blank Pdffiller

Vermont Department Of Taxes Facebook

Vermont Income Tax Vt State Tax Calculator Community Tax

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller