does north carolina charge sales tax on food

The State of North Carolina charges a sales tax rate of 475. To learn more see a full list of taxable and tax-exempt items in North Carolina.

.png)

States Sales Taxes On Software Tax Foundation

Aviation Gasoline and Jet Fuel.

. Counties and municipalities in North Carolina charge additional sales tax with rates between 2 and 275 for a maximum rate of 75. Candy however is generally taxed at. North Carolina doesnt collect sales tax on purchases of most prescription drugs.

Make Your Money Work A number of categories of goods also have different sales tax rates. 53 rows Twenty-three states and DC. In most states necessities such as groceries clothes and drugs are exempted from the sales tax or charged at a lower sales tax rate.

North Carolina Sales Tax Rates. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. Food Non-Qualifying Food and Prepaid Meal Plans.

Candy is subject to the combined state and local sales tax rate. Even if separately stated delivery charges are subject to sales tax. Dry Cleaners Laundries Apparel and Linen Rental Businesses and Other Similar Businesses.

Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries. Secretary of Revenue Decision No 2003-176 North Carolina Department of Revenue October 29 2003 Posted on April 15 2004. If the service you provide includes creating or manufacturing a product you may have to deal with the sales tax on products.

Some services in North Carolina are subject to sales tax. Candy however is generally taxed at. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

Some repair maintenance and. Treat either candy or soda differently than groceries. Services in North Carolina are generally not taxable with important exceptions.

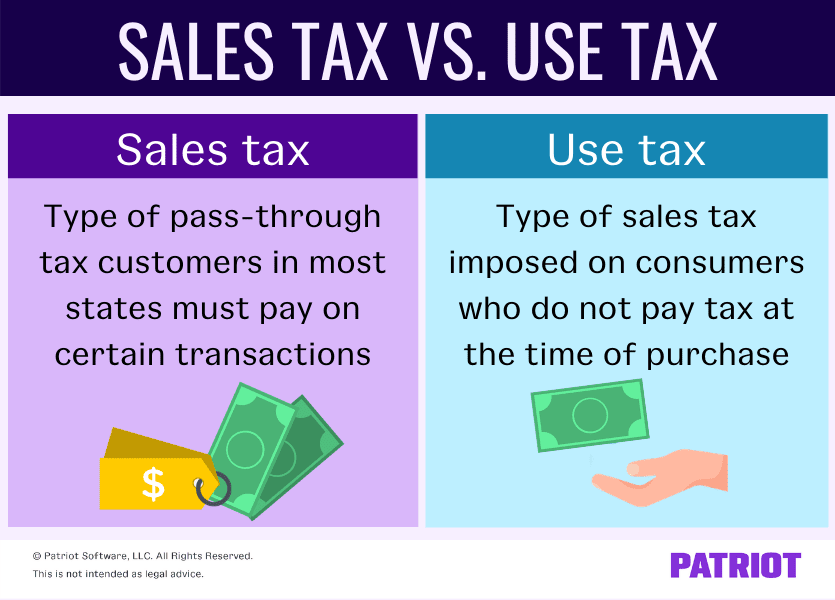

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. A series of brief background reports on issues related to budgets taxes and government assistance programs.

General Sales and Use Tax. Join 16000 sales tax pros who get weekly. Prescription Medicine groceries and gasoline are all tax-exempt.

The following rates apply at the state and city level. Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming. Because each county and city charges a slightly different sales tax rate in North Carolina it is.

Goods that are subject to sales tax in North Carolina include physical property like furniture home appliances and motor vehicles. Some counties also consider a limited number of services such as laundry and dry cleaning taxable. State Budget and Tax.

Aircraft and Qualified Jet Engines. This page describes the taxability of food and meals in North Carolina including catering and grocery food. However separately stated charges for installation services are excluded from sales tax.

In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. But North Carolina does charge the 2 or 225 percent local sales tax on qualifying food exempting food purchases only from the statewide sales tax and the transit tax. Food and food ingredients excluding alcoholic beverages and tobacco are subject to a lower rate of 2.

Kit Kats contain flour. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Semantics aside in North Carolina.

This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that serve food. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in research and development.

The transit and other local rates do not apply to qualifying food. Ergo they are food. Groceries and prepared food are subject to special sales tax rates under North Carolina law.

/GettyImages-9096554281-5b4b5b6b46e0fb0037843703.jpg)

How To Handle Sales Taxes When You Sell Across State Lines

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax Exemptions Finance And Treasury

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Are You Required To Pay Sales Tax On Restaurant Food Purchased For Resale

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

Sales Taxes In The United States Wikiwand

How To Calculate Sales Tax A Simple Guide Bench Accounting

Sales Tax On Grocery Items Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

North Carolina Sales Tax Small Business Guide Truic